Download the factsheet

X

Your Complete Guide to the EU Carbon Border Adjustment Mechanism

Get clear, practical answers on what CBAM means for your business, how the 2026 changes affect costs, and how supplier emissions data drives your exposure. CarbonChain provides the data, workflows and reporting tools to help you comply with confidence.

Trusted By

Industry Leaders

Industry Leaders

Jump to

What is CBAM?

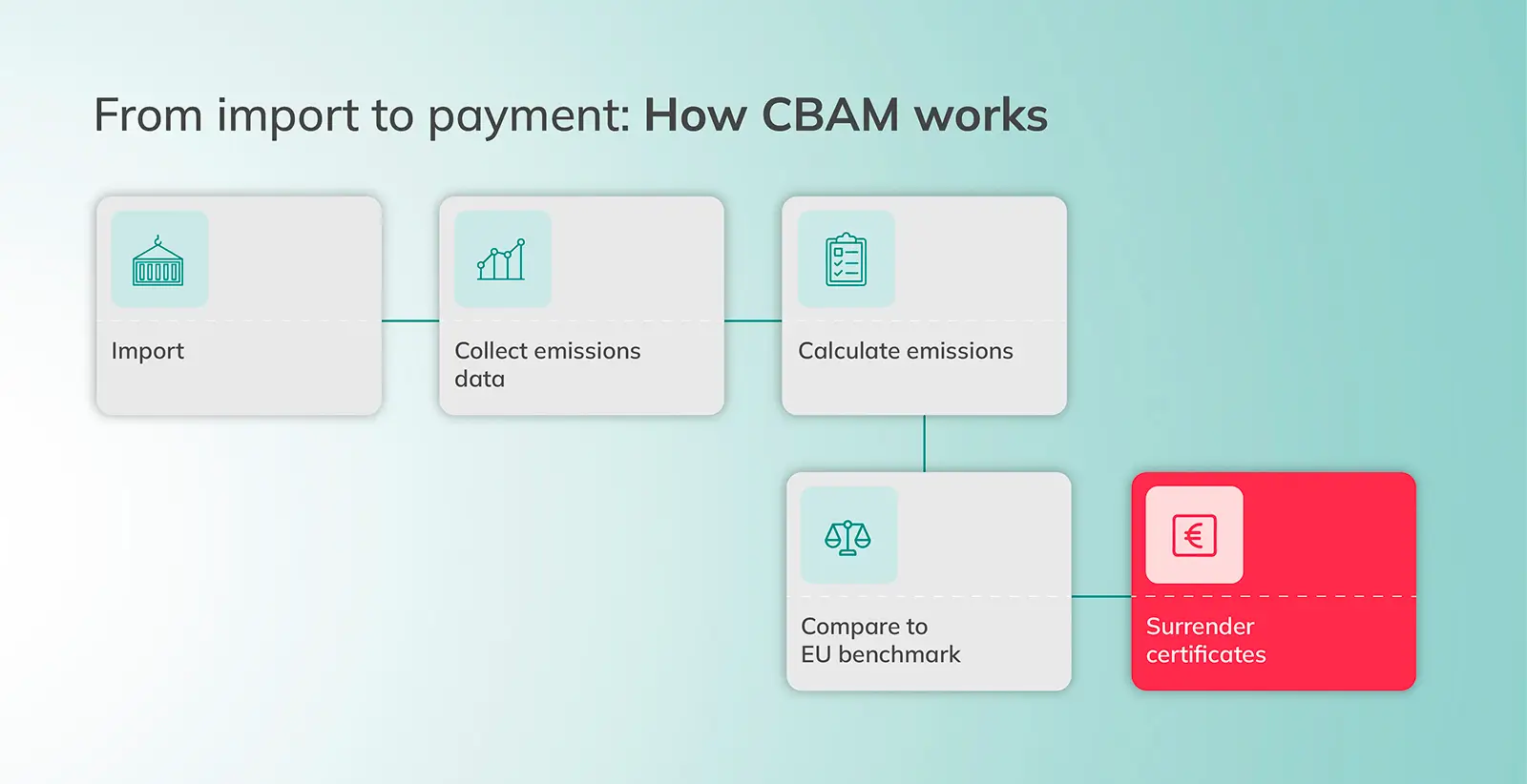

The Carbon Border Adjustment Mechanism is the European Union’s carbon border policy. It ensures that imported goods face a similar carbon price to goods produced inside the EU under the EU Emissions Trading System.

The EU describes CBAM as an environmental policy tool for fair carbon emissions pricing, which aims to prevent carbon leakage, protect the competitiveness of EU industries and encourage adoption of lower carbon production globally.

UK CBAM will follow a similar structure. It is scheduled to come into effect from 2027, with details still emerging. Both regimes share the same goal: a fair and transparent carbon price on imported goods.

Who does CBAM apply to?

Importers and Declarants

EU-based buyers importing in-scope goods. Required to collect actual emissions from suppliers, calculate CBAM cost, and report via the CBAM Registry.

Installations and Producers

Non-EU producers supplying in-scope goods to the EU. Required to provide actual emissions data to customers so they can calculate exposure. From 2026 actual values are essential.

Traders and Intermediaries

Entities moving goods into or through the EU who may be responsible for CBAM declarations depending on contract structure and delivery terms or want to understand the associated CBAM cost of a trade.

Other Stakeholders

Consultants, auditors, procurement teams, downstream producers and logistics providers increasingly affected by customer requests for emissions data.

What Changes in 2026?

From 1 January 2026, CBAM entered its definitive period. Importers will begin paying for embedded emissions using CBAM certificates, which marks a fundamental change that will impact both procurement costs and supplier relationships. Here are four key things to bear in mind.

Default values are punitive, actual values will be required

Supplier specific emissions data must be verified by an accredited third party to be used. If a supplier does not undertake - or fails - verification, actual emissions data cannot be used and default data/ benchmarks will apply instead. For complex goods producers, such as for steel or aluminium product manufacturers, upstream data will need to be verified in order to be included in CBAM declarations. Producers may use a mix of actual or default data in their calculations.

New EU benchmark values

The European Commission has introduced commodity-code specific benchmarks that define the emissions thresholds for CBAM when using both actual and default values. Installations must now calculate their own product-level benchmarks which must be used by importers when reporting, using actual data.

If no actual data or benchmark is available from an installation then a default value must be applied. The default value benchmarks are lower than earlier drafts, raising CBAM exposure for most products covered by CBAM. Default benchmarks are set by country, production route of the goods and CN code.

Costs come into effect from 1st January 2026

Any CBAM goods that are customs cleared, and released for free circulation, into the EU from 1st January 2026 are subject to EU CBAM costs. CBAM cost is calculated based on the emissions embedded in the CBAM goods that are above the product-level benchmark, adjusted by the phase-in rate, and then multiplied by the relevant quarter's CBAM Certificate price (minus eligible carbon prices paid abroad). The CBAM Certificate price is set quarterly in 2026 and then weekly from 2027 onwards. Here's how to calculate your cost exposure.

CBAM Registry updates

The EU CBAM Registry will become the central system for managing emissions reporting and certificate management. Annual declarations replace quarterly reporting, though quarterly data preparation for forecasting and cost accrual management is still a fundamental exercise.

Read our CBAM Briefing Pack for more info on compliance & cost exposure

Does CBAM Apply to Your Business?

CBAM coverage depends on your location, the goods you import or export, the CN codes involved and your annual tonnage. The rules differ for importers, installations and traders.

At its core, CBAM applies to goods imported into the EU that would have paid a carbon price if they had been produced inside the EU under the EU Emissions Trading System. If you are involved in supplying, selling, or importing these goods into the EU, CBAM is already relevant to you.

Products currently covered

If a product you import into the EU falls under a covered CN code and has a country of production outside the EU, then you are obligated to report under EU CBAM, with a financial liability starting from January 1, 2026.

Many companies underestimate their exposure because they focus on headline product categories rather than the specific CN codes used in customs declarations, which is where CBAM applicability is determined.

Who CBAM affects in practice

CBAM generally impacts two sets of businesses: producers of CBAM goods outside of the EU and importers of CBAM goods into the EU.

- CBAM affects producers, because their EU customers need verified, installation-level emissions data to comply with their reporting obligations and avoid using default values.

- Importers are impacted because they are subject to reporting obligations and CBAM costs associated with their imports from 1 January 2026.

- CBAM also affects traders and intermediaries who structure transactions into the EU, even if they never physically handle or customs clear the goods, as they have a responsibility to pass CBAM installation data to their customers in the EU to facilitate their compliance.

For example, a non-EU steel mill exporting rebar into Europe is squarely within CBAM scope, because rebar is a covered steel product. A UK company with an EU subsidiary that imports aluminium products into the EU is already subject to EU CBAM today and the UK business will also face UK CBAM obligations should they import aluminium into the UK once the UK CBAM comes into force, currently expected from 1 January 2027.

CBAM is expanding beyond today’s scope

The current product list is not the end state. On 17th December 2025 the European Commission stated explicitly that CBAM will expand over time to close carbon-leakage gaps and align more closely with the EU ETS. This expansion is expected to move further downstream into steel and aluminium value chains including 180 steel and aluminium-intensive products, like machinery, appliances and vehicles, ensuring emissions are reduced rather than relocated.

The vast majority of these downstream goods concerned (94%) are industrial supply chain products with a high (on average 79%) steel and aluminium content, and are used in heavy machinery and specialised equipment, such as base metal mountings, cylinders, industrial radiators, or machines for casting.

A small share of the downstream goods concerned (6%) are also household goods. An EU producer of such downstream products can face increased costs for the steel and aluminium materials used in the production process.

As a result, many downstream manufacturers who are not formally “in scope” today are already being pulled into CBAM in practice. Their customers need upstream emissions data to complete their own CBAM reporting, and gaps in that data increasingly translate into commercial friction or lost business.

Examples:

A non EU steel mill exporting rebar into Europe will be covered.

A UK importer of aluminium extrusions will be covered under UK CBAM from 2027.

A trader handling material under DDP terms may become the declarant.

How do I Calculate my CBAM Costs?

CBAM becomes a cost regulation on January 1, 2026. Every 0.1 tCO₂e/t difference in emissions intensity changes cost by ~€9/t, directly impacting margins. Importers and traders alike will need to able to answer critical questions such as:

- What will CBAM cost me next year?

- How do I quickly compare suppliers?

- What if my supplier data is unreliable?

- How do I model benchmark uncertainty?

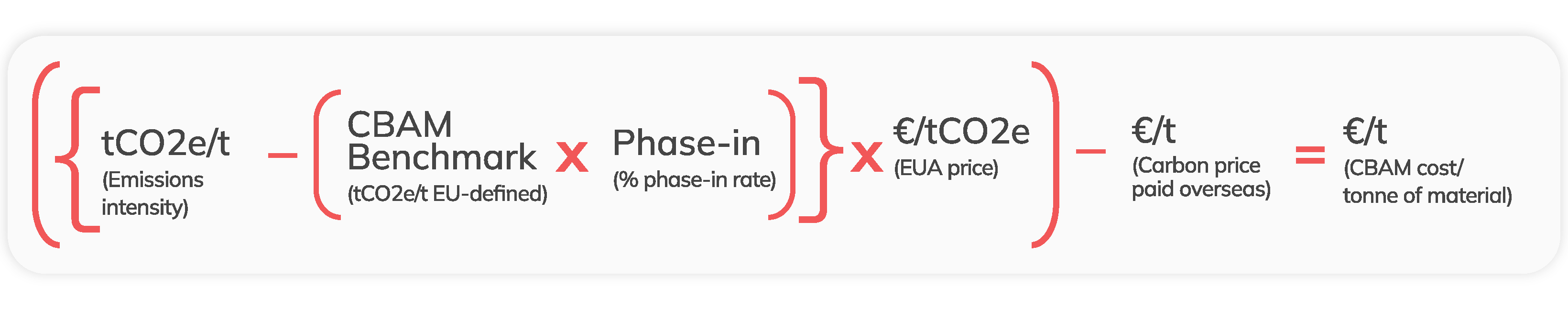

As an example, an importer of CBAM goods to the EU would calculate their costs using the following formula:

More specifically, the terms in the formula refer to:

- Emissions Intensity = the producer's direct embedded emissions intensity of their CBAM goods for aluminium and steel products; both direct and indirect for fertiliser and cement CBAM goods. Emissions data must cover the 2026 period and be verified by a third-party accredited verifier. Without verified data, country-level default values must be used.

- CBAM Benchmark & Phase in Rate = the benchmark set by either the installation or default value, which decreases at the rate of the phase-out of the free allowances under the EU ETS.

- Carbon price paid overseas = the carbon price already paid overseas covering a proportion of the emissions intensity of the CBAM goods. This is deducted in order to determine the net CBAM obligation.

- CBAM certificate price = in 2026 the quarterly-average closing price of the EU Emissions Trading System price. This changes to a weekly average from 2027 onwards.

Running the CBAM formula accurately across multiple suppliers, CN codes, and production routes is both difficult and time-consuming to do manually. To help out with this we have created our CBAM Calculator, which automates default values, benchmarks, and phase-in rates. This lets you model costs per tonne and compare suppliers in seconds rather than spreadsheets.

Get instant CBAM cost modelling

Why is CBAM Difficult for Most Companies to Manage?

CBAM introduces a level of operational, data, and financial complexity that most producers and importers are not equipped to manage with existing processes. What begins as a reporting obligation quickly becomes a cross-border data, verification, and cost-exposure challenge. These are the areas where most companies struggle.

Supplier data collection

CBAM shifts responsibility upstream, requiring importers to collect installation-specific emissions data from global suppliers. For complex products such as steel and aluminium products, this includes verified emissions across each production stage, including for relevant precursors. Many producers lack the systems, expertise, or incentives to provide this data, making collection slow, fragmented, and highly manual.

Data quality and consistency

Supplier data often passes through multiple tiers, geographies, and production routes before reaching the importer. Producers are frequently unclear on what qualifies as CBAM-compliant data, leading to gaps, inconsistencies, or unusable submissions. Where verified upstream data cannot be obtained, importers are forced to rely on default values - significantly increasing reported emissions and costs.

Complex methodologies

CBAM calculations go far beyond simple emissions factors. Importers must define system boundaries, track precursor emissions, distinguish between production routes, and prepare for verification-grade scrutiny. Verification does not only assess the final numbers - it evaluates how data is collected, governed, stored, and integrated into calculations across the entire workflow.

Benchmark and price volatility

CBAM cost exposure is directly linked to EU ETS dynamics. EUA prices rose sharply in 2025 and are expected to increase further as CBAM enters its definitive phase in 2026. Companies that delay building robust data and supplier processes risk locking in higher costs through default values, while uncertainty makes it difficult to plan, budget, and commit to long-term action.

Verification pressure

To use actual emissions data, companies must undergo third-party verification, including an on-site audit in the first year and assessment against a strict 5% variance threshold. Verification capacity is tightening as accreditation rules evolve. If verification is delayed or unsuccessful, default values apply - removing cost control at precisely the moment financial liability begins.

How CarbonChain Helps You Manage CBAM

CBAM for Importers (Declarants)

- Actual emissions validation: Replace punitive default values with supplier-specific emissions data that is reviewed by our in-house carbon accounting expert team, enabling you to reduce your CBAM cost exposure.

- Automated supplier outreach: Request, track, and manage CBAM data from dozens or hundreds of suppliers in one place, without email chains or manual follow-ups.

- Benchmark comparisons and scenario modelling: Understand how each supplier compares to peers and model CBAM cost exposure under different benchmarks and carbon price assumptions.

- Clean audit trail: Maintain a clear, defensible record of data requests, submissions, assumptions, and calculations to support internal review and future verification.

- Reporting aligned with EU requirements: Generate CBAM reports that follow EU templates and methodologies, reducing the risk of rework or non-compliance as enforcement tightens.

Talk to one of our experts

CBAM for Producers (Installations)

- Precursor and process data organisation: Structure raw activity data, precursor inputs, and production routes in a way that meets CBAM rules and customer expectations.

- Installation-level emissions modelling: Calculate embedded emissions at the installation-level using a consistent, verification-ready approach rather than via ad hoc spreadsheets.

- Verification-ready data packages: Prepare datasets that are structured, traceable, and ready for pre-verification, reducing audit risk and last-minute firefighting.

- Benchmark and competitor comparisons: See how your emissions intensity compares to peers and identify where carbon cost is helping or hurting your competitiveness.

- Support for tenders and commercial positioning: Use credible CBAM data to respond faster to customer requests, support EU tenders, and differentiate low-carbon production.

- Go beyond CBAM Compliance with GHG Protocol Aligned Product Carbon Footprints: CarbonChain can readily support the extension of your EU CBAM compliance with full-scope Product Carbon Footprints through our SGS validated methodology, covering all traded commodity products.

Talk to one of our experts

Supplier Catalogue

- Public directory of steel and aluminium installations: Search a growing database of known CBAM-relevant suppliers by entity and CN code.

- Request supplier risk ratings for free: Identify potential cost and data-quality risks before engaging deeply with a supplier.

- Access emissions intensity data: Unlock installation-level intensity data to replace assumptions with evidence.

- Compare suppliers and CBAM cost implications: See how supplier choices translate directly into €/tonne cost differences under CBAM.

- Optional upgrade to full CBAM reporting: Move seamlessly from discovery and comparison into end-to-end CBAM reporting when you’re ready.

Explore the Supplier Catalogue

How to Comply with CBAM: Importers

Importers (authorised declarants) are legally responsible for CBAM compliance, reporting, and cost exposure. Their challenge is coordinating supplier data, managing financial liability, and meeting registry reporting requirements.

How to Comply with CBAM: Producers

Producers are not directly regulated by CBAM, but their data determines whether importers can avoid defaults and manage cost exposure. Verified, installation-level data becomes commercially critical.

Sector Specific Guidance

Relevant CN codes

72XX codes and selected

73XX downstream items

73XX downstream items

Typical default ranges (eg. HRC)

Low: ~2.6-3.5tCO2/t (TR, CN, RS)

High: ~4.5-9.05tCO2/t (ZA, IN, ID)

High: ~4.5-9.05tCO2/t (ZA, IN, ID)

2026 benchmark considerations

Steel products are generally all complex as they have precursor inputs. This makes actual benchmark and emissions calculations more difficult due to reliance on upstream supplier data. The default benchmarks and country-level intensities vary significantly by production route (e.g. BF-BOF, Scrap-EAF, DRI-EAF) and country of origin.

Cost sensitivity factors

- Production route

- Country of origin

- Mill's ability to provide verified, actual data

- Timing of import

- High carbon-to-value ratio

- Margin on traded product

Example CBAM cost scenario

A 10,000t shipment of blast furnace steel from a high-emitting country using default values (3.5tCO2/t) at €80/EUA could face €1.7M in CBAM costs in 2026. The same tonnage with verified actual data (1.9tCO2/t) from the mill might reduce this to under €450K.

Relevant CN codes

76XX codes and selected products

Typical default ranges (eg. Billet)

Low: ~1.87tCO2/t (SA, QA, MY)

High: ~2.3-3.5tCO2/t (MZ, CN, ZA)

High: ~2.3-3.5tCO2/t (MZ, CN, ZA)

2026 benchmark considerations

Aluminium products are simpler than steel products as there are no precursor inputs to primary aluminium production. As a result, both the default and actual process-level benchmarks for primary aluminium are equal. Downstream products may face benchmark calculation complexities where they are using both remelt secondary aluminium (remelt scrap ingot) and primary aluminium.

Cost sensitivity factors

- Production routes

- Supplier's ability to provide verified, actual data

- Timing of import

- Low carbon-to-value ratio

- Margin on traded product

Example CBAM cost scenario

A 10,000t shipment of primary aluminium from a high-emitting country using default values (2.6tCO2/t) at €80/EUA could face €970k in CBAM costs in 2026. The same tonnage with verified actual data (1.8tCO2/t) from the smelter might reduce this to under €330K.

Relevant CN codes

2808, 2814, 2834, 3102, 3105

Typical default ranges (eg. Urea)

1.4-1.5tCO2/t for key suppliers

(EG, RU, DZ)

(EG, RU, DZ)

2026 benchmark considerations

Fertilisers have well-defined process routes and the impact in 2026 hinges on whether suppliers can provide verified emissions data or force importers to fall back to defaults.

Cost sensitivity factors

- Feedstock (gas vs coal)

- N₂O controls in nitric acid

- Supplier's ability to provide verified, actual data

- Timing of import

- High carbon-to-value ratio

Example CBAM cost scenario

A 10,000t urea shipment using default values could trigger €430K+ in CBAM costs. Verified data from a modern, gas-fed plant with N₂O abatement could reduce this by 40-50%.

Relevant CN codes

2507 & 2523

Typical default ranges

0.6-0.9 tCO₂e/t cement

2026 benchmark considerations

Cement benchmarks are tight and cement has a high share of process emissions (calcination), so fuel switching only goes so far. Location considerations play a key role in the sourcing of cement into the EU.

Cost sensitivity factors

- Clinker ratio

- Kiln thermal efficiency and fuel type

- Distance/ logistics

Example CBAM cost scenario

A 10,000t shipment of grey clinker from Morocco at €80/EUA could face €270k in CBAM costs in 2026. The same tonnage with verified actual data (0.8tCO2/t) from the producer might reduce this to €120K.

CBAM Resources

If you would like to learn more about CBAM here are some key resources for additional reading and information. The below includes official guidance from the EU Commission and UK Government, practical tools and insights from CarbonChain, as well as a list of frequently asked questions.

Official Guidance

CarbonChain Tools & Resources

From our Blog

FAQs

Is EU CBAM a tax?

CBAM is not officially a carbon tax. However, from 2026 onwards it will function in similar ways to a carbon tax, by requiring companies to make financial payments (or 'adjustments') according to the greenhouse gas (GHG) emissions embedded in their imports of aluminium, steel, fertilisers, electrical energy, hydrogen and cement.

Importers will report these emissions, then purchase and surrender CBAM certificates at the same cost per tonne of carbon dioxide equivalent to the average EU ETS carbon price for the past quarter in 2026, and then for the past week from 2027 onwards.

What sectors are included in EU CBAM?

CBAM covers high-emitting commodities including electricity, cement, aluminium, fertilisers, iron, steel and hydrogen. Certain precursors and other downstream products like screws and bolts are also included. Learn more from CarbonChain’s CBAM products and CN codes guide.

What is the difference between EU ETS and CBAM?

The EU EmissionsTrading System (ETS) sets a cap on the amount of greenhouse gas (GHG) emissions that can be released from industrial installations in certain sectors within the EU. Allowances are bought on the ETS trading market.

CBAM complements the EU ETS by covering goods imported from outside the EU. When fully phased in, it will cover more than half of the emissions in ETS-covered sectors. Unlike the ETS, there will be no 'cap and trade' system under CBAM.

Is EU CBAM the same as the UK CBAM?

No.

Although both systems aim to prevent carbon leakage by putting a carbon cost on imports, they will operate under similar, but distinct, rules, timelines and administrative systems. Learn more about UK CBAM.

Do simple and complex goods have different reporting requirements?

A simple good has no CBAM-covered materials as inputs (e.g., primary aluminium ingot). A complex good uses CBAM-covered goods as precursors (e.g., aluminium extrusions, which use primary or secondary aluminium as an input).

When it comes to CBAM reporting, for simple goods there is no need to include embodied emissions from upstream materials or energy inputs.Only direct emissions (and indirect for certain products, as described above)from the good’s own production process are reported.

By contrast, CBAM reporting for complex goods includes embodied emissions from upstream materials used in its production, which must be taken into account.

Are Scope 3 emissions included in EU CBAM?

EU CBAM does not use the categories of Scopes 1, 2 and 3. Therefore, it can be misleading to talk about Scope 3 emissions being included in CBAM. However, certain emissions that fall under the Scope 3 category are included in specific ways.

CBAM classifies emissions as either direct emissions or indirect emissions, while traditional corporate carbon accounting classifies emissions by Scopes.

Under CBAM, direct emissions are those released from the installation’s own production processes, including emissions from on-site electricity generation. Indirect emissions refer solely to emissions from the off-site generation of electricity consumed by the installation.

Note: under the ‘Scopes 1, 2 and 3’ framework, emissions associated with on-site generation of electricity (e.g. for a diesel generator) are categorised as Scope 1(direct) emissions, not Scope 2. This can be a source of confusion for companies who have already calculated emissions according to Scopes or who use ‘direct emissions’ synonymously with Scope 1.

For so-called complex goods, additional upstream emissions are also included under CBAM, specifically emissions involved in the processing of raw materials that are used as inputs to make those complex goods.

Those emissions do fall under the Scope 3 category of standard carbon accounting. For example, in the case of steel sheets, the emissions of precursor goods like sinters and pellets need to be included in CBAM reporting and are part of the steel sheet'sScope 3.

However, the category of Scope 3 emissions includes many more emissions sources than just the direct processing of precursor goods. Therefore, CBAM counts fewer emissions than a full Scope 3 accounting exercise would, even for complex goods.

How do I become an authorised CBAM declarant?

You need to apply through your member state's national competent authority via the CBAM Registry. Applications require company identification, EORI number, and evidence that you're involved in importing CBAM goods. Additional information relating to the competencies of the organisation with regards to EU CBAM reporting are also required (CarbonChain can support this application, as required).

Each EU member state has a designated competent authority(see the next question for more information). Approval is required before youcan submit declarations or purchase CBAM certificates. The deadline for applications for Authorised Declarant Status is 31 March 2026.

Where is the CBAM registry and how do I use it?

The CBAM Registry is the EU's central platform for managing CBAM compliance:

· Apply for authorised declarant status

· Submit annual declarations

· Purchase and surrender CBAM certificates

It replaces the transitional reporting portal used during the Transitional Period (for imports recorded through to the end of 2025). Access is granted once you're approved as a declarant by your National CompetentAuthority.

What are the key CBAM deadlines for 2026 and 2027?

2026: The definitive phase begins 1 January 2026. CBAM costs apply to all in-scope goods released for free circulation into the EU from this date. Quarterly reporting ends and annual declarations begin. You must hold authorised declarant status or have submitted an application for the authorised reporting status before importing to ensure avoidance of penalties.

Throughout 2026, you need to prepare data for your first annual declaration. There are no external reporting obligations for EU CBAM in2026 for importers. Installations should continue to report annual installation data to their customers, updated on a quarterly basis for the previous 12months. It is recommended that installations undergo pre-verification in 2026.If you’d like to learn more about the pre-verification process, then please reach out.

2027: On a quarterly basis, declarants must hold at least 50% of the required certificates for the prior quarter's imports by the end of each quarter. The 2026 CBAM declaration and full certificate surrender for 2026 is due by 30 September2027. CBAM certificate pricing moves from quarterly to weekly averages in 2027.Installations must perform their verification in advance of the September 2027deadline for their importing customers, and ideally well in advance.

What happens if my supplier can’t provide emissions data?

If your supplier cannot provide actual, verified emissions data, you'll be required to use default values. These defaults are intentionally conservative and typically higher than actual emissions, meaning your CBAM costs will be higher than if you had real data.

For complex goods manufacturers (e.g. steel and aluminium products) your upstream precursor data must also be verified to be used. If any part of the chain is missing, defaults apply to that portion. This makes supplier engagement and verification a commercial priority and not just a compliance exercise.

What are CBAM default values and when to they apply?

Default values are standardised emissions intensities published by the European Commission for each CBAM product category. They're set by country and production route, and are designed to reflect the higher end of emissions for that product type.

Defaults apply when:

· Your supplier doesn't provide data

· The data fails verification or the data doesn't meet CBAM methodology requirements

From 2026, relying on defaults instead of verified actuals will significantly increase your CBAM cost exposure. The Commission revised default benchmarks downward in late 2025, which actually raises CBAM exposure for most products.

How do I get supplier emissions data verified?

Supplier emissions data must be verified by an accredited third-party before it can be used in CBAM declarations. The first official verification covers the 2026 calendar year and includes an on-site audit of the installation.

Verifiers assess the data itself, and the methodology used to collect it (including system boundaries, precursor emissions, and production route allocations). Verifiers will review both your emissions intensity figures and your benchmarks.

Verifiers apply a 5% materiality and if verification fails or is delayed past your declaration deadline, you revert to default values.

What if you’ve already paid a carbon price abroad?

You can deduct equivalent carbon costs paid in the country of production from your CBAM liability. This applies to explicit carbon pricing mechanisms like carbon taxes or emissions trading schemes.

You'll need documentation proving the carbon price was paid, the amount per tonne of CO2, and that it applies to the specific goods you are importing. The deduction is calculated on a per-tonne basis and applied before you calculate your certificate obligation.

What are the penalties for CBAM non-compliance?

Penalties mirror those under the EU Emissions TradingSystem. If you fail to surrender enough CBAM certificates, you'll face a fineof €100 per tonne of CO2 equivalent not covered.

Paying the penalty doesn't remove your obligation as youstill need to surrender the missing certificates.

Failing to report or register as an authorised declarantcan result in additional sanctions determined by member states, includingpotential exclusion from importing CBAM goods.

The EU has indicated it will enforce this strictly fromday one of the definitive phase.

Will CBAM expand to cover more products?

Yes.

On 17 December 2025, the European Commission confirmedthat CBAM will expand further downstream into steel and aluminium value chains.This includes approximately 180 additional product categories coveringmachinery, appliances, vehicles, and industrial equipment with high steel andaluminium content.

The goal is to close carbon leakage gaps and align moreclosely with EU ETS coverage. This means many companies not currently "inscope" will be pulled into CBAM in practice, as their customers needupstream emissions data for their own reporting.

Timing for the expansion is still being finalised, butplanning for any affected businesses should start now.